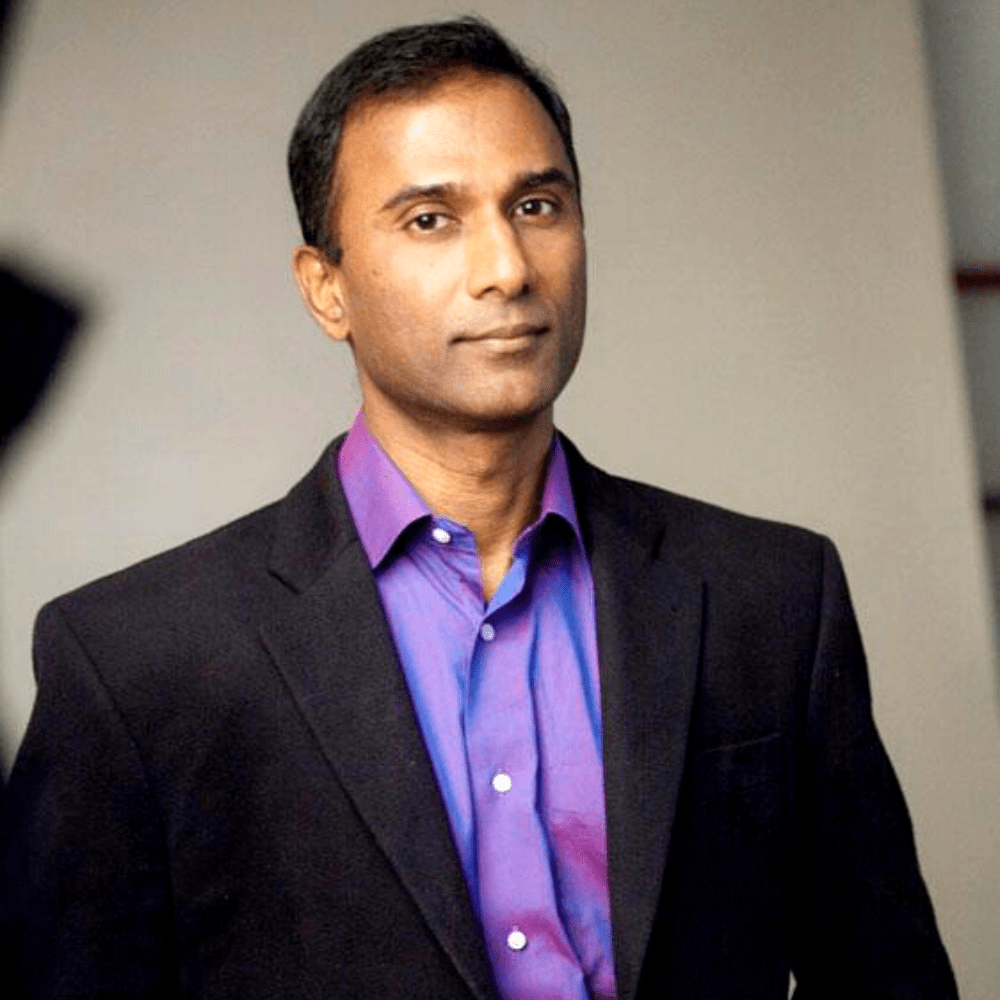

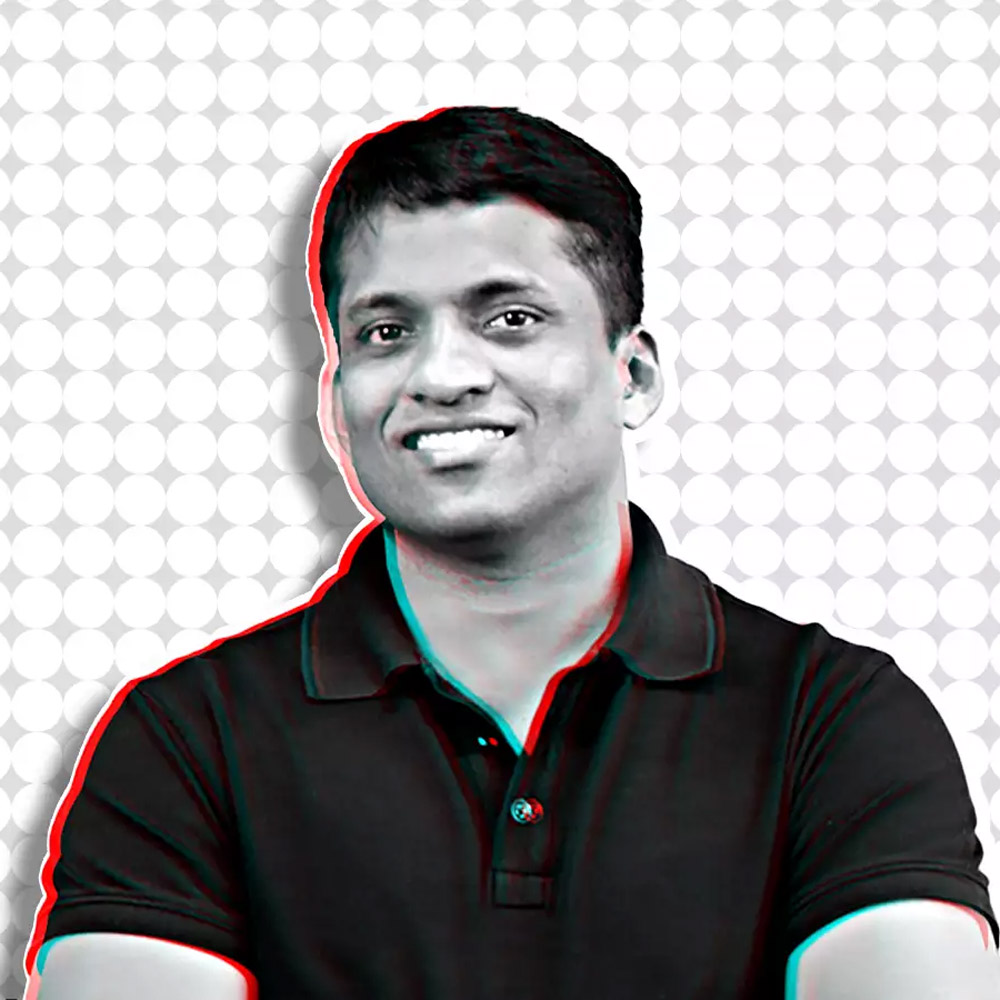

Avnish Anand takes over CaratLane as CEO

Avnish Anand takes over CaratLane as CEO

Avnish Anand, CaratLane’s cofounder and COO, has been appointed to CEO with immediate effect, just days after his previous employer and cofounder Mithun Sacheti quit the company, selling his shares to Tata Group’s timepiece behemoth Titan.

Sacheti and his family owned 27.18% of the firm, which was acquired by Titan last week for INR 4,621 crore, valuing CaratLane at INR 17,000 crore (about $2 billion). Titan currently controls 98.28% of CaratLane.

Titan will fund the transaction using a combination of cash balances, internal accruals, and debt, according to the business. The transaction is still subject to regulatory clearance from India’s Competition Commission (CCI) and other closing conditions.

If all permissions are obtained, the transaction is scheduled to be finalised by October 31st.

Former CaratLane CEO Sacheti’s exit was also one of India’s greatest ecommerce exits, second only to the Walmart-Flipkart deal, in which the two cofounders, Sachin Bansal and Binny Bansal, each received more than $1 billion for their interest in the ecommerce behemoth.

The business also said that cofounder Gurukeerthi Gurunathan will continue to serve as CaratLane’s chief technology officer (CTO).

“Mithun has been a pillar of support and a sounding board for all of my ideas over the years, so it’s understandably sad to see him go.” But I’m extremely happy for this new chapter since we have a fantastic chance ahead of us to grow a bigger and more outstanding business,” Anand, CaratLane’s new CEO, said in a statement.

through addition, the remaining 1.72% of the startup’s equity is held through ESOPs for 75 of its 400 corporate workers. Given that Titan will also be acquiring the remaining interest in CaratLane, these workers are expected to earn INR 340-380 Cr as compensation.

CaratLane, founded in 2008 by Mithun Sacheti and Srinivasa Gopalan, is an omnichannel business that makes and sells jewels in India and the United States. The firm competes with other domestic jewellery startups such as GIVA, BlueStone, and Melorra.

The D2C brand has shown significant development over the last three years, with total revenue increasing from INR 723 Cr in fiscal year 2020-2021 (FY21) to INR 1,267 Cr in FY22. In FY23, its total income increased by more than 71% year on year (YoY) to INR 2,177 Cr.

PhysicsWallah Expands its Offline Presence and Announces the Opening of 26 New PW Vidyapeeth Centres

PhysicsWallah, an edtech unicorn, has announced the opening of 26 new PW Vidyapeeth facilities across India, as well as the introduction of scholarships worth INR 200 crore through its PWNSAT 2023 program (Physics Wallah National Scholarship cum Admission Test).

‘My social media profits are not accurate,’ Virat Kohli says of Instagram Rich List 2023 rumours

Indian cricketer Virat Kohli denies receiving $1,384,000 per Instagram post, saying the accusations are false. Indian cricketer Virat Kohli denied accusations from Instagram Rich List 2023 that he receives $1,384,000

Following Joe Biden’s China tech sanctions, US investors are concerned about reprisal

While the market mostly ignored President Joe Biden’s decision to limit some US technology investments in China, US investors expressed concern that Beijing might retaliate or refrain from purchasing American technology.

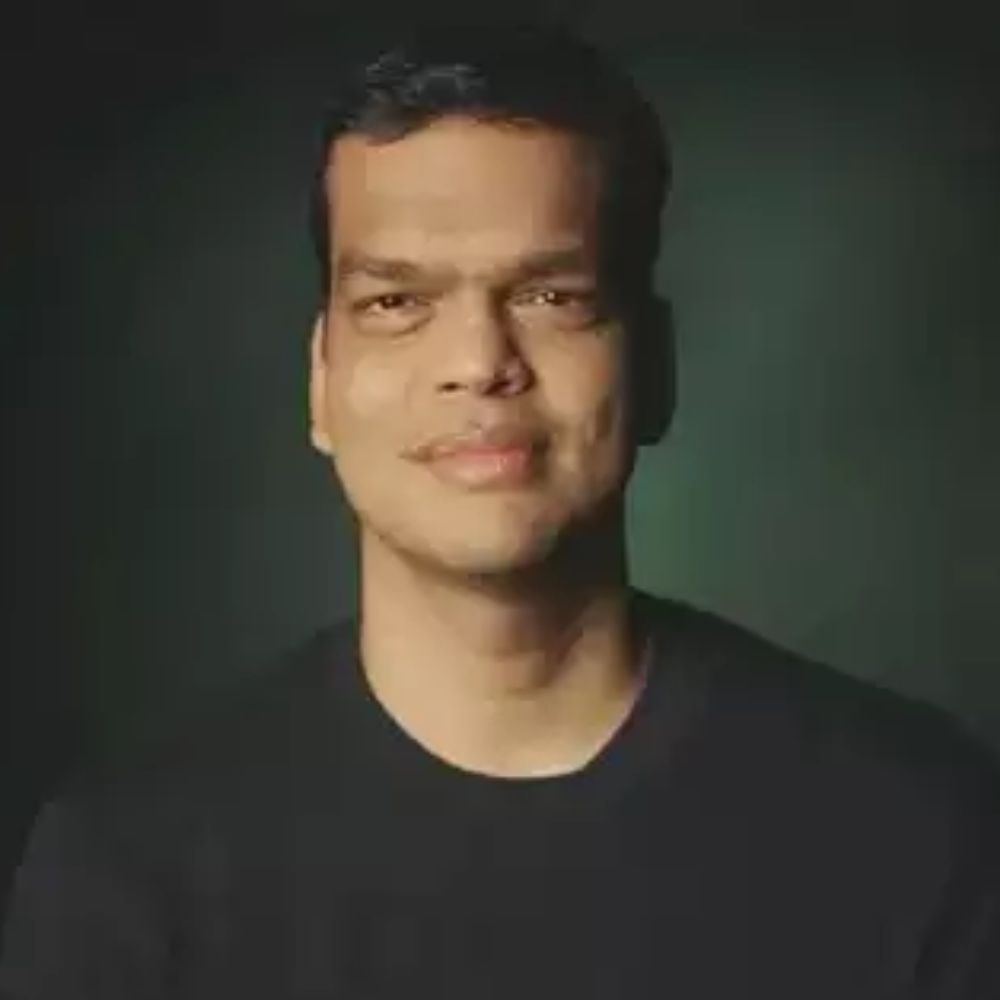

‘Ability to stay invested indefinitely’: Zerodha invests Rs 1,000 crore in Rainmatter to support businesses

Nithin Kamath, CEO of Zerodha, stated on Wednesday that the company has expanded its investment in its startup accelerator fund, Rainmatter. According to Kamath, the allotment has been enhanced by Rs 1,000 crore. He noted that the fund has invested about Rs 400 crore in the last seven years.

Capgemini will invest 2 billion euros in artificial intelligence as a result of greater half-year sales

Capgemini, a French IT consulting firm, reported stronger half-year revenue on Friday, driven by its cloud, data, and artificial intelligence (AI) activities, and announced it will invest 2 billion euros ($2.19 billion) in AI over three years.

The Success Story Of Parul Gulati: B-Town Diva, Business Mind: An Entrepreneur’s Story Of A Rs. 50 Crore Start-Up

In addition to her acting career, well-known Bollywood actress and model Parul Gulati has started a wonderful business. She has been successful in establishing “Nish Hair,” a business that sells hair extensions and may bring in up to INR 1 crore in monthly sales.

Cognizant and Gilead Sciences agree to a $800 million deal

On Monday, Cognizant made an announcement that it was extending its IT service agreement with Gilead Sciences for an additional $800 million in estimated value over the following five years, continuing the current pattern of software giants landing huge deals.

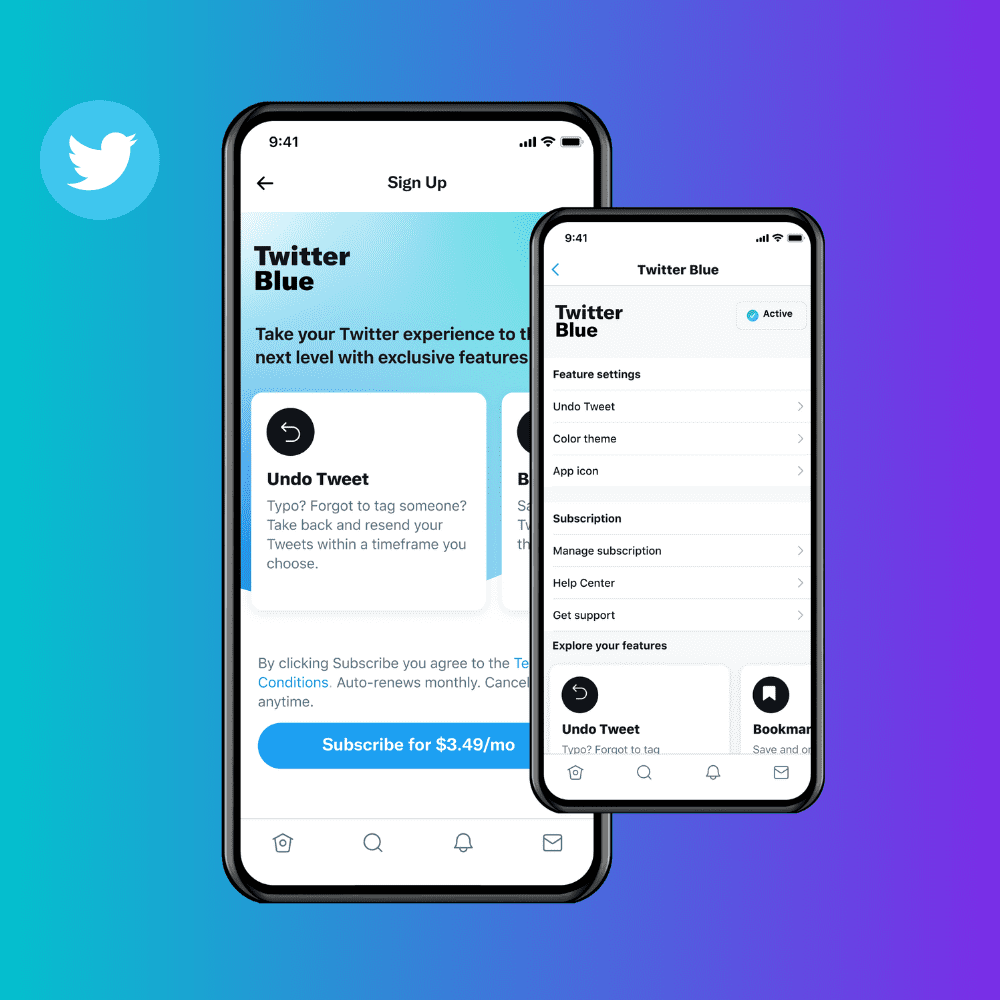

The introduction of a jobs tool on Twitter will put it in direct competition with LinkedIn

Twitter appears to be working on a job posting function or jobs tool on Twitter that would enable recognized firms to post job postings on their profiles in an effort to compete with the professional social networking site LinkedIn.

Following the announcement of “one of the largest ever investments,” UK Prime Minister Rishi Sunak and Tata Sons Chairman N Chandrasekaran met

Tata Sons revealed plans to build a gigafactory in the UK with the ability to create 40GW of batteries yearly. Customers in the UK and Europe will receive electric mobility and renewable energy storage solutions thanks to the over £4 billion investment.

Live streamers from China are focusing on TikTok sales to consumers in the US and Europe

Despite doubts about the platform’s future in the US and other countries, live streamers from China have focused on TikTok users in the US and Europe, peddling anything from bags and clothing to crystals with an eye on a potentially profitable market.

With 70% less investment, startups in India seek to reduce the burn rate

With a 70% decline in investment since FY22, Indian entrepreneurs are experiencing a financial winter, requiring them to reduce the burn rate and accelerate their route to profitability. According to Redseer’s examination of 100 unicorns, the number of profitable unicorns will increase from 30 in FY22 to 55 in FY27.

Google Play adjusts its policy towards blockchain-based apps, paving the way for tokenized digital assets and non-fungible tokens

Google has revised its mobile software marketplace policy to allow application developers to integrate digital assets such as NFTs into their games via its Google Play app store, according to Joseph Mills, the company’s group product manager.

Tesla is in talks to establish a factory in India to produce electric vehicles starting at Rs 20 lakh, according to a report

Tesla has been meeting with industry executives in India in addition to interacting with the government. According to the Economic Times, Tesla is actively exploring the prospective creation of its

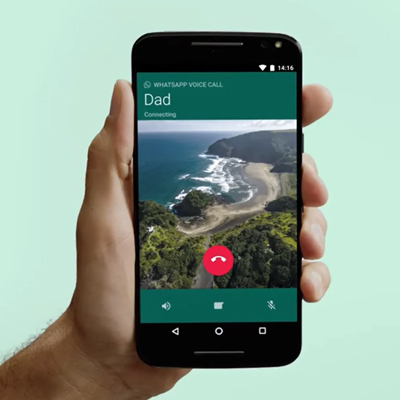

WhatsApp’s Phone Number Privacy feature is now available in Beta

WhatsApp has introduced a new feature called ‘phone number privacy’ for Android and iOS users, which allows customers to hide their phone numbers in community groups. The feature is now available to beta users and will be made available to a larger audience soon.

Meet Indian-origin women on the ‘America’s Richest Self-Made Women’ List, including Jayshree Ullal, Neerja Sethi, Neha Narkhede, and Indra Nooyi

With a total net worth of $4.06 billion, four Indian-origin women reached the Forbes list of America’s 100 richest self-made women. With a total net worth of $4.06 billion, four

Meet Sagar and Binod, St. Xavier’s alumni and the minds of Wow Momo: Here’s how they grew their business from Rs 30000 to a multi-billion-dollar enterprise

Today, we’ll tell you about the people who contributed to Wow!’s success. Momos- the momo wallas who entirely destroyed the momo-selling market-Sagar and Binod’s entrepreneurial adventure serves as an inspiration to dream big and turn passions into reality.

‘I am truly frightened,’ says Paytm CEO Vijay Shekhar Sharma after reading an OpenAI post regarding human extinction

Paytm CEO Vijay Shekhar Sharma has expressed concern about the potential disempowerment, if not extinction, of humans as a result of the development of extremely advanced AI systems. He expressed his concerns in a tweet, citing a recent blog article by OpenAI.

There is enough Headroom for India to add 1 lakh unicorns and 20 lakh startups, according to MoS Rajeev Chandrasekhar

Rajeev Chandrasekhar, Minister of State for Electronics and Information Technology, feels that India is well-positioned to produce 1 lakh unicorns and 10-20 lakh startups in the future.

‘Loan approval in 30 seconds’: Flipkart collaborates with Axis Bank to offer personal loans to customers

Flipkart has teamed with Axis Bank to provide personal loans to its 450 million consumers, with amounts ranging from lakh to lakh and various repayment choices. Loan approval is intended to take about 30 seconds, providing customers with convenience and accessibility.

Pankaj Goel of Razorpay has been appointed as the new CTO of BharatPe

Since 2022, the fintech business BharatPe has been embroiled in a series of issues. Several C-suite executives have left the organization. Pankaj Goel has been appointed as the company’s new Chief Technology Officer by fintech upstart BharatPe.

MoS Rajeev Chandrasekhar claims that India won’t be impacted by China’s export restrictions on gallium and germanium

Gallium and germanium exports from China are being restricted; according to Minister Rajeev Chandrasekhar, a new India is engaging with the international community to create supply chains that are more resilient.

During IPL 2023, fantasy gaming platforms earned INR 2,800 crore in gross revenue

During the most recent season of the Indian Premier League, the fantasy gaming platforms market in India had a significant surge. According to a RedSeer analysis, gross revenues of fantasy sports platforms in India reached INR 2,800 Cr during IPL 2023, up from INR 2,250 Cr in IPL 2022, thanks to a 24% YoY rise and a 30% CAGR.

HealthifyMe will launch an online store this quarter, with CEO Tushar Vashisht ruling out an IPO in the near future

Tushar Vashist, the creator and CEO of HealthifyMe, spoke with Mint about the company’s IPO prospectus, AI-based nutritionist Ria, future expansions, and his forthcoming musical event.

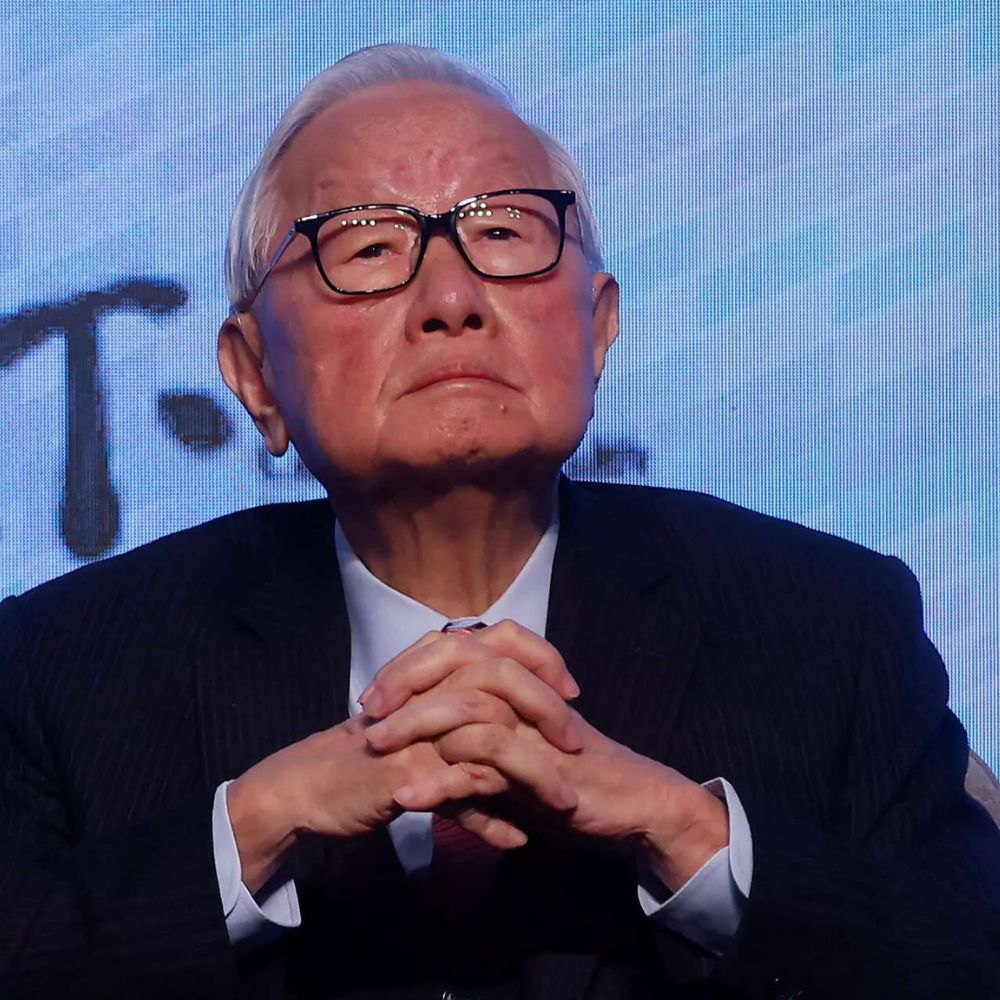

Technology globalization is taking a back seat to national security, according to TSMC founder Morris Chang

According to the retiring founder of Taiwanese chipmaker TSMC, Technology globalization is taking a second seat to concerns such as national security and technological leadership, with US-China relations consisting more of competition than cooperation.

Launching a $50 million fund to support entrepreneurs using AI is Good Capital

Good Capital, a seed-stage, India-focused venture capital firm, on Friday, unveiled a new $50 million fund to support founders who are utilizing Artificial Intelligence for marketing, customer service, or business operations.

Linda Yaccarino, Twitter’s new CEO, settles into the spotlight

According to four persons with knowledge of the conversations, Linda Yaccarino, 60, has spoken with several of Twitter’s advertisers about objectionable content on the website. She hasn’t, however, gone out and actively haggled with advertisers to raise Twitter’s earnings.

As Microsoft defends its $69 billion Activision merger, the future of a record tech sector alliance rests with the court

Federal antitrust officials have filed a lawsuit to stop the $69 billion deal, which they claim will hurt Microsoft’s competition with rivals in the game sector like Sony and Nintendo.

A federal judge must now determine whether to block Microsoft from consummating its acquisition of the video game company Activision Blizzard, which could be the most expensive merger in the history of the technology sector.

TalentSprint, which is owned by the NSE Academy, earns Rs 100 crore in income in FY23

TalentSprint, an ed-tech startup, was bought in November 2020 by NSE Academy, a wholly-owned subsidiary of the National Stock Exchange. Since the acquisition, the Hyderabad-based company has performed admirably, surpassing the Rs 100 crore revenue mark in FY23.

Flowie wants invoices to flow freely

Meet Flowie, a new French startup that seeks to make money transfers between businesses easier. The company centralizes all accounts receivable and payable information so that everyone in the company can view essential information when it comes to getting paid by clients and receiving money from suppliers.

Gautam Adani dismisses the Hindenburg report as “targeted misinformation,” claiming that a US short-seller profited from Adani’s share price decline

Gautam Adani stated in his shareholder statement that Hindenburg gained money by deliberately driving down Adani group stock prices. Gautam Adani, Chairman of the Adani Group, stated that the report

Baskit, a supply chain startup, assists Indonesian middlemen

Large brand distributors dominate the top of the supply chain, but thousands of middlemen, including wholesalers, form partnerships with retailers at the bottom. Baskit, which was founded last year, seeks to give them tools to digitize the management of their goods and services in order to assist them acquire better rates. The Indonesian firm revealed today that it has raised $3.3 million in seed funding from Betatron, Forge, 1982, Investible, DS/X, Orvel, and Michael Sampoerna. This comes three months after a $1.5 million seed round.

How Poland landed a multi-billion dollar investment from Intel

In order to lessen its reliance on Asia in the face of an unprecedented semiconductor scarcity, Europe is providing billions of euros in subsidies. In exchange, Intel is making significant financial commitments, and Poland chose to join the celebration since Germany had already secured a 30 billion euro investment.

After the meltdowns of last year, cryptocurrency investors increase risk management

Institutional cryptocurrency investors are transferring to exchanges that provide tighter asset protection, increasing due diligence on trading counterparties, and performing trades in smaller chunks in order to safeguard themselves.

Sriram Krishnan will lead the opening of Andreessen Horowitz’s first international office in London

The company said in a statement that the London office, which will open later this year, will engage with institutions in the UK and assist the development of blockchain technology and entrepreneurs. It will be overseen by one of the firm’s general partners, Sriram Krishnan.

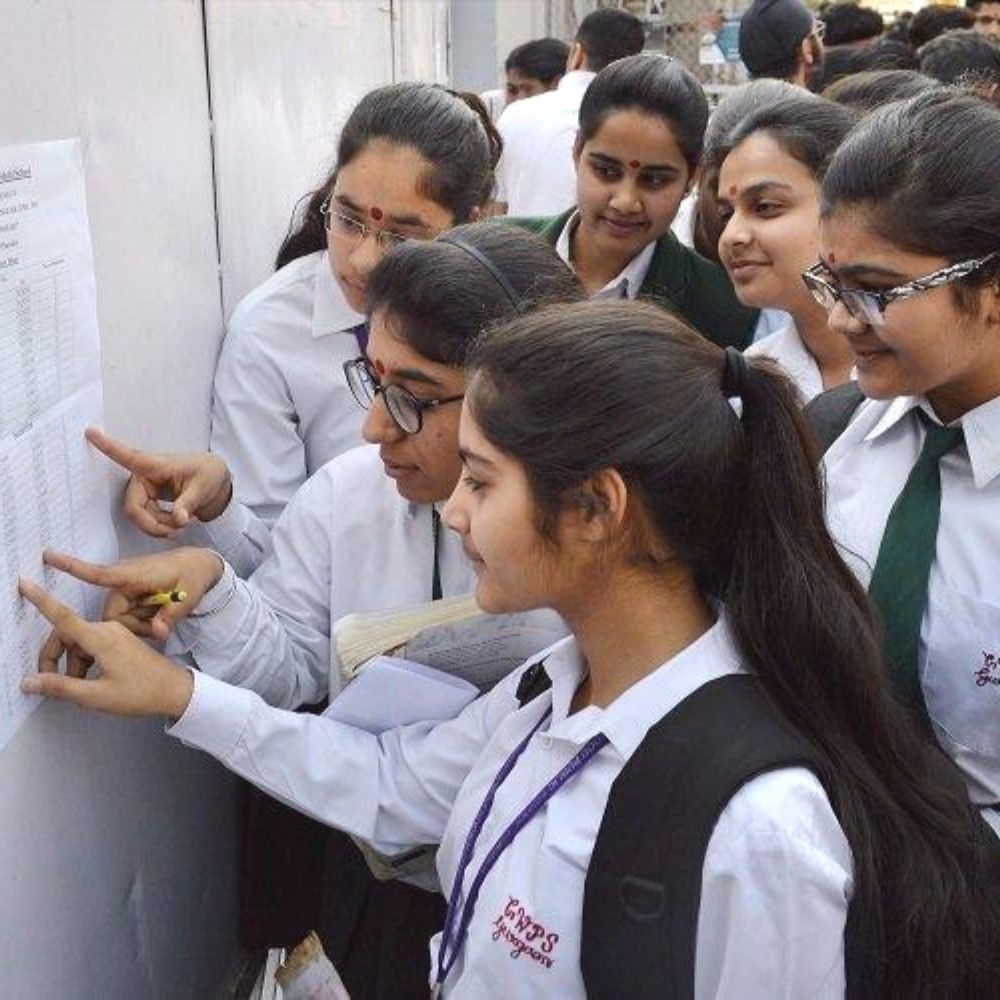

MHT CET 2023 Result Has Been Announced On Cetcell.mahacet.org; Direct Link To Download PCB, PCM Scorecards Is Available Here

The MHT CET Result 2023 is now available on the official website cetcell.mahacet.org; scroll down for a direct link to get Maharashtra CET scorecards for the PCB and PCM groups.

On Monday at 9 a.m., the Assam Higher Secondary Education Council announced the class 12th results

On Monday at 9 a.m., the Assam Higher Secondary Education Council announced the results. Students can check their results at any of the following websites: ahsec.assam.gov.in, resultsassam.nic.in, assamresult.co.in, and assam.result.in.

Capillary Technologies receives $45 million in funding from Avataar Ventures and its LPs after postponing its IPO

Avataar Ventures and its limited partners (Pantheon, 57Stars, and Unigestion), Filter Capital, and Innoven Capital also participated in the funding round. Capillary Technologies, a Bengaluru-based SaaS business, has raised $45

Madhabi Puri Buch, the chairman of the Sebi, is adamant about establishing an ethical council to oversee wrongdoing in the MF industry

Madhabi Puri Buch stated during the launch of the Association of Mutual Funds in India’s new office in Mumbai’s Bandra-Kurla complex that if the AMFI fails to adopt self-regulation measures,

Startups in stock brokerage Groww and Upstox are looking into lending and payments to broaden their revenue stream

Growing their credit operations are Groww and Upstox, two significant challenger brands in the broking industry, according to sources. The ultimate goal is to keep clients who come to the

Poonam Ajgaonkar has been appointed chief people officer at healthtech firm Qure.ai.

According to the organization, Ajgaonkar’s skills will be critical in attracting and retaining top talent, increasing employee engagement, and developing an inclusive work culture globally. According to a statement made

Shares of Adani Enterprises fell by 2% when they reverted to the ASM framework

Stock exchanges have since May 25 placed Adani Enterprises within the short-term extra surveillance framework. Following the stock exchanges’ placement of Adani Enterprises under the short-term extra surveillance framework beginning

‘Big Four’ accounting firms are looking at the professional involvement of the airline in the Go First incident

Go First crisis: Following a request for proposals from accounting firms to serve as the struggling airline’s resolution professional (RP), the big four and Grant Thornton have entered the fray.

Narayana Murthy, the founder of Infosys, seeks to increase private company investment

Through his creative approach to outsourcing technology services, Narayana Murthy significantly contributed to making Infosys a well-known firm in India. Over the next five years, the investment company overseeing the

Top VCs debate investment strategy and corporate governance failings at Indian companies when they gather in Bengaluru

Top VCs discussed how corporate governance issues are now playing out in Indian companies and looked into ways for early-stage VC firms to implement effective controls that encourage adherence to

Manish Chopra, the head of the Meta India Partnership, leaves his position; this is the fourth significant departure in the past several months

Ajit Mohan, the former head of India, left in November 2022, as did Rajiv Aggarwal, the head of public policy, and Abhijit Bose, the head of WhatsApp India. Manish Chopra,

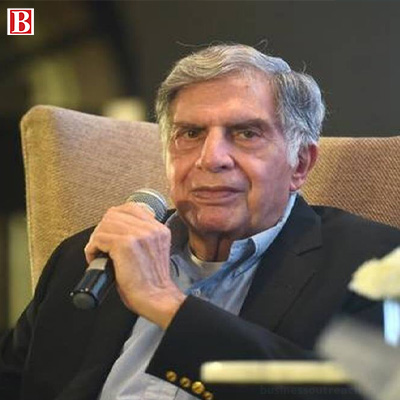

Upstox, funded by Ratan Tata and Tiger Global, achieves profitability in FY23 and records $1 billion in sales

Ratan Tata and Tiger Global-backed Upstox is seeking both organic and inorganic expansion options and currently has financial reserves of over Rs 1,000 crore. Ratan Tata-backed discount broker Upstox achieved

Until recently, ONDC had to push individuals, but Paytm and PhonePe backing helped the government-backed platform grow by 100 times

As anticipated, the release of the specific app Pincode from Walmart-owned finance startup PhonePe in early April led to a spike in orders. The other significant buying app on the

After revealing AI “snapshots” for Google Search, Alphabet shares soar 5%, increasing the company’s market value by $56 billion

In addition to offering a new iteration of its namesake engine, Google stated that it will be implementing additional artificial intelligence for its primary search product. Alphabet shares soar 5%,

WhatsApp for Android adds additional features such as muting unknown callers and a bottom navigation bar

The option to mute calls from unknown numbers, a revised user interface with a bottom navigation bar as WhatsApp for Android adds additional features, the ability to construct single-vote surveys,

We aim to be in business so that we may declare profits of $5 billion to $6 billion globally: Monika Shergill works at Netflix India

Netflix India’s VP of Content Monika Shergill said the company wants to run a profitable and sustainable business rather than a race to the bottom. Monika Shergill, Vice President of

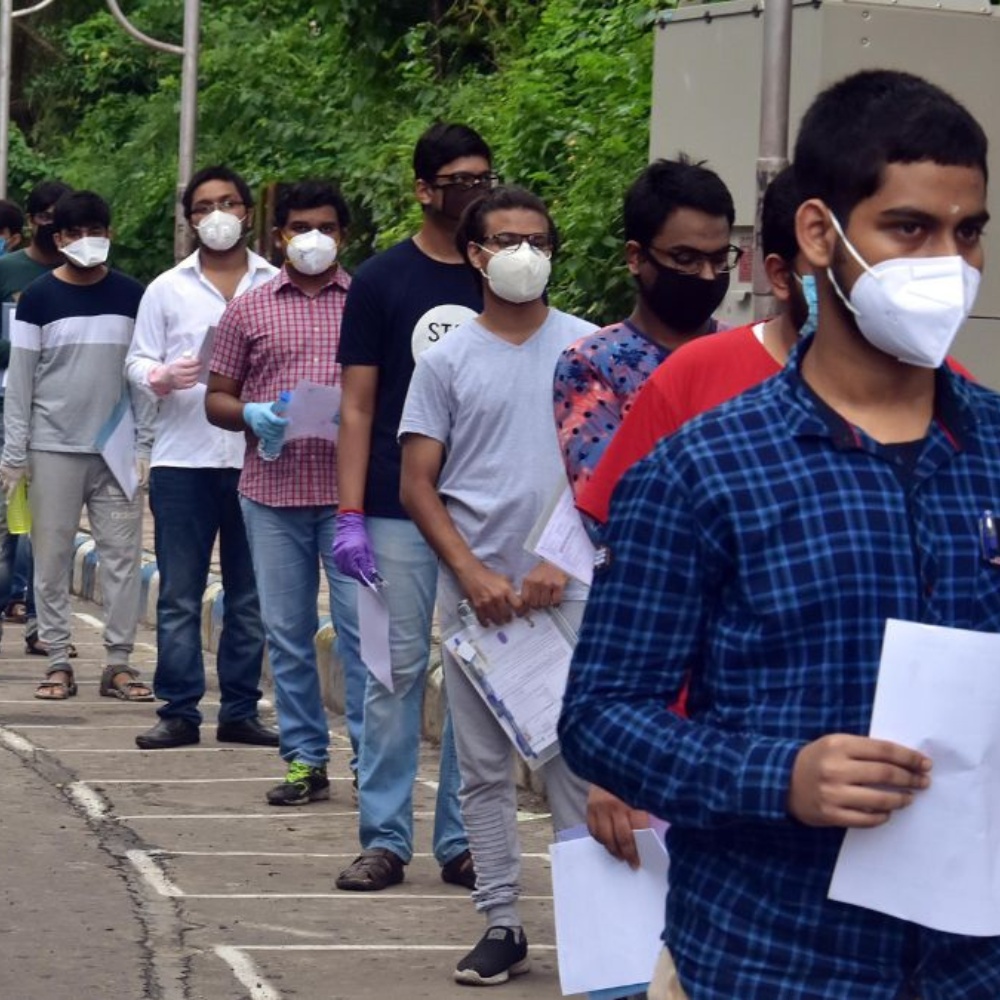

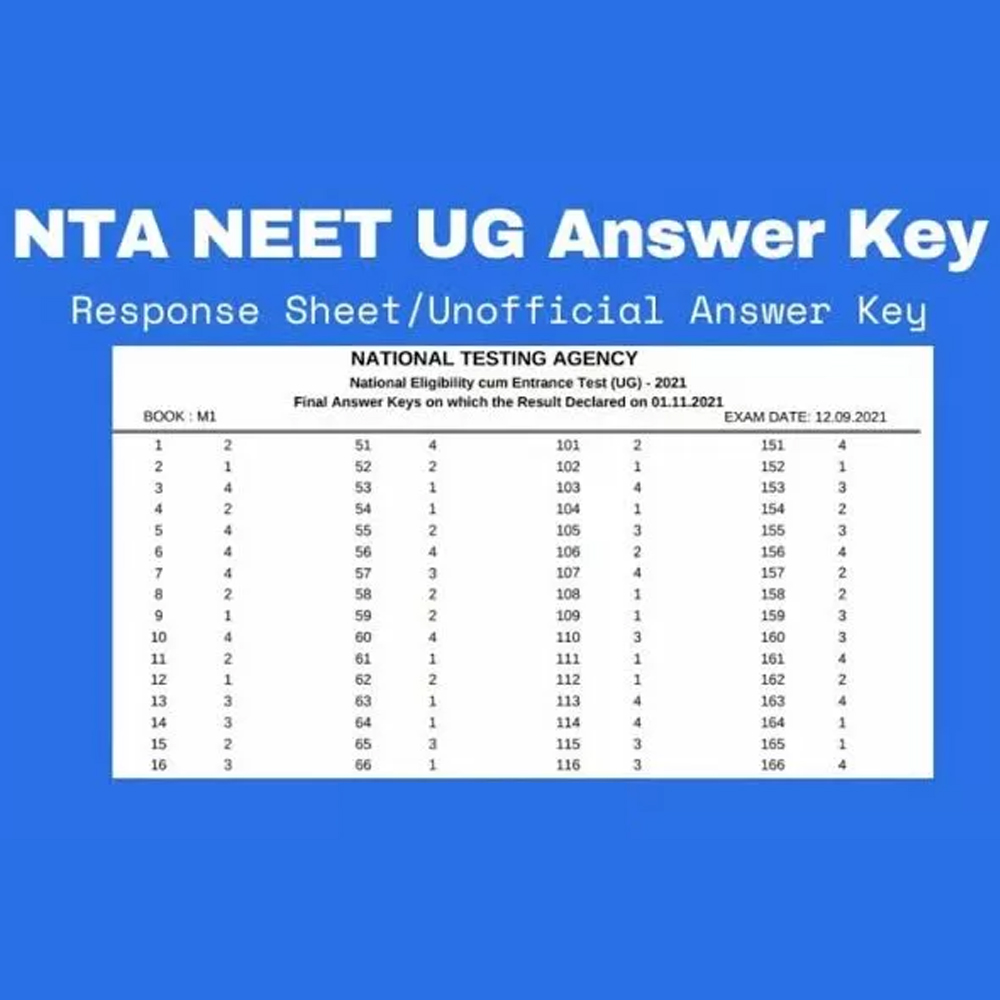

NEET Admit Card 2023: The NTA NEET UG hall ticket is now available at neet.nta.nic.in; here’s how to get it and other information

NEET admit card 2023: The NEET UG exam is scheduled for May 7th. Today, May 4, the National Testing Agency (NTA) released the National Eligibility Cumulative Entrance Test for Undergraduate

Reid Hoffman, the co-founder of LinkedIn, has launched a ChatGPT-like chatbot with his new AI business, Inflection

Similar to the popular chatbot ChatGPT, Inflection’s AI chatbot Pi engages users through dialogues in which they can ask questions and discuss common interests. The AI business Inflection AI, created

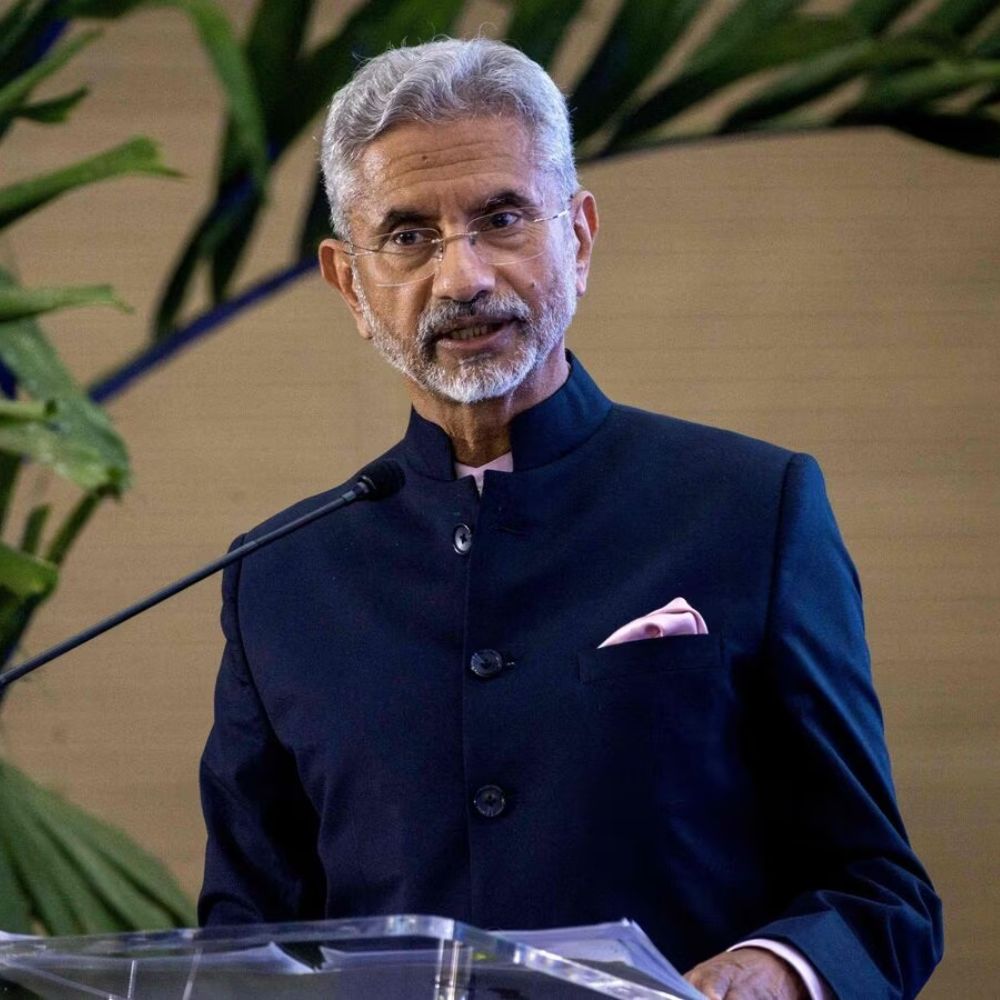

From pharmaceuticals to paper goods, trade between India and the Dominican Republic has surpassed $1 billion, according to S Jaishankar

From pharmaceuticals to paper goods, trade between India and the Dominican Republic has surpassed $1 billion. S. Jaishankar, the minister of external affairs, continued by stating that before 20 years

Freshworks: A SaaS (Software as a Service) company that provides customer support, sales, and marketing automation solutions

Let’s be frank about the fact that most employees hate the software they use for work. Business software has a long history of being criticized for being bulky, expensive, demanding

eBay anticipates increased revenue as trainers and reconditioned items drive growth

eBay Inc forecasted current-quarter revenue above Wall Street predictions on Wednesday, after exceeding March-quarter earnings estimates, as it benefits from its strategy of focusing on product categories such as trainers

Hinduja Group is the sole bidder for Reliance Capital, with a bid of Rs 9,650 crore: Report

Meanwhile, Torrent Investments and Oaktree Capital, both of which had previously stated their intention to participate in the process, did not submit any bids. IndusInd International Holdings, a Hinduja Group

From Rs 10 lakh to Rs 50 lakh in monthly revenue, these Namita Thapar-backed start-ups are dominating the healthtech industry

The Shark Tank Several entrepreneurs in India created innovative solutions in the health tech field for the Indian market. Spandan and Janitri are two of them. The healthcare sector in

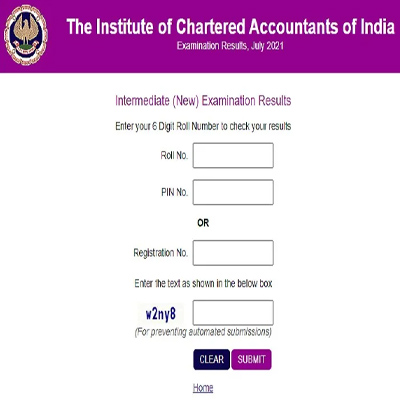

A 24-year-old CA starts a fund worth Rs 100 billion for startups and SMEs

Chanakya Opportunities Fund I, a Sebi-registered Category II Alternative Investment Fund, will invest in successful SME firms with growth potential in unorganized industries; start-ups in manufacturing, consumer goods, and technology

Results for Nestle India’s first quarter show profit rising 25% to Rs 737 crore and revenue rising 21%, which is the company’s greatest rise in a decade

According to Nestle India, it had its strongest quarter of growth in the previous ten years. This does not include a standout quarter in 2016 that was an anomaly because

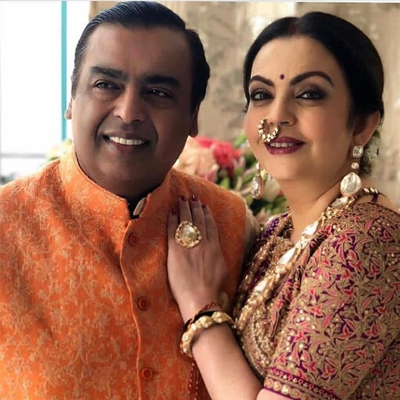

The owner of the Mumbai Indians makes more money than Mukesh Ambani, and his family has contributed to the development of Reliance Industries

The individual is credited for having been instrumental in numerous important Reliance Industries projects. Nikhil Meswani, please. He manages the day-to-day operations of the Mumbai Indians, Mukesh Ambani’s IPL cricket

In FY23, India sold 7.3 lakh electric two-wheelers, with Ola Electric leading the market

In FY23, India sold 7.3 lakh electric two-wheelers, with Ola Electric leading the market. Indians purchased 60,000 electric two-wheelers per month. According to Redseer, the country’s E2W penetration is expected

The DGGI has issued show cause notifications to HDFC Bank, Go Digit, and Policybazaar for tax evasion totaling Rs 2,250 crore

In the previous 15 days, DGGI officials have issued summons and notices to these intermediaries. At least 120 insurance brokers and aggregators from throughout the country are being investigated. The

Vedanta-Foxconn semiconductor plans to incorporate STMicroelectronics in a joint venture have encountered a snag

The presence of STMicroelectronics as a technical partner in the Vedanta-Foxconn chipmaking project is critical since it will help the consortium qualify for the Centre’s Rs 76,000 crore incentive program.

‘Look at what’s going on in India,’ Nirmala Sitharaman advises foreign investors

Finance Minister Nirmala Sitharaman was addressing the Peterson Institute for International Economics (PIIE) during a fireside conversation about the Indian economy’s growth. Finance Minister Nirmala Sitharaman has advised investors to

Jamshyd Godrej notes the strength of Vietnam and other manufacturing centers, saying “India has not done that yet”

India should address some concerns first, according to Jamshyd Godrej, chairman of Godrej & Boyce, in order to resolve the difficulties in the manufacturing industry. It has been extensively debated

Reliance Retail establishes a flagship store in Mumbai and introduces the e-commerce beauty platform Tira

Isha Ambani, Executive Director of Reliance Retail Ventures Limited, stated that the company’s goal with Tira is to remove obstacles from the beauty industry and democratize beauty for customers across

Forbes lists Mukesh Ambani, one of the world’s wealthiest people, as having an $83.4 billion net worth, along with the Kamath brothers from Zerodha

According to Forbes, Ambani’s oil-to-telecom juggernaut Reliance Industries became the first Indian business to generate more than $100 billion in sales last year. According to Forbes’ Billionaire 2023 list, which

Byju’s and Swiggy investments are devalued by BlackRock and Invesco amid changes to the tech valuation

Byju’s has been enacting cost-cutting measures, including two waves of layoffs that affected about 3,500 workers, to reduce losses. Byju’s and Swiggy’s value from American investors decreased last year, according

Increased competition and postponed tariff increases could effectively result in a Jio-Airtel duopoly

The Indian telecom sector may become a two-player game, Increased competition and postponed tariff increases could effectively result in a Jio-Airtel duopoly with Reliance Jio and Bharti Airtel stepping up

The government imposes a tax on Gpay, Paytm, and other services for transactions over 2,000

The NPCI has proposed surcharges on merchant transactions on the Unified Payments Interface for prepaid payment instruments (PPI). The National Payments Corporation of India (NPCI) issued a circular proposing “Prepaid

WE Hub, a women’s startup incubator, has partnered with Australia’s Cyber West Sign to expand prospects for Australian and Indian startups

WE Hub a women’s startup incubator, inked a Memorandum of Understanding (MoU) on Sunday with Cyber West Sign, an Australian digital marketing agency, to promote cross-border prospects for companies in

Maximizing corporate value through automation: A streamlined path to digital transformation

IT automation has progressed from an idea to a process that provides enormous economic benefits. Companies, particularly those adopting the hybrid work paradigm, are discovering that technological resources, including intelligent

Ledger introduces a browser add-on to enhance connection for cryptocurrency wallets

One of the biggest companies offering cold storage cryptocurrency wallets, Ledger, has introduced a browser plugin to boost digital asset connectivity and online security, the business exclusively revealed to TechCrunch.

A Bad Word Is “Unicorn” FreshtoHome’s CEO says the IPO is the final test of valuation, and the company plans to list in three years

When the pandemic was at its worst, during the peak of the unicorn boom in India, start-ups were more interested in discussing their astronomically high valuations than their actual businesses.

Meet Indian-American entrepreneur Vivek Ramaswamy, who is running for President of the United States in 2024

Following the announcements of former US President Donald Trump and former South Carolina governor and former UN Ambassador Nikki Haley, Vivek Ramaswamy has joined the Republican presidential field. Nikki Haley

Binance CEO Zhao confirms that the company is withdrawing from potential investments in the United States

According to Bloomberg, Binance is also reevaluating its American venture capital investments and will consider delisting tokens from any US-based enterprises. Binance has backed away from some possible investments in

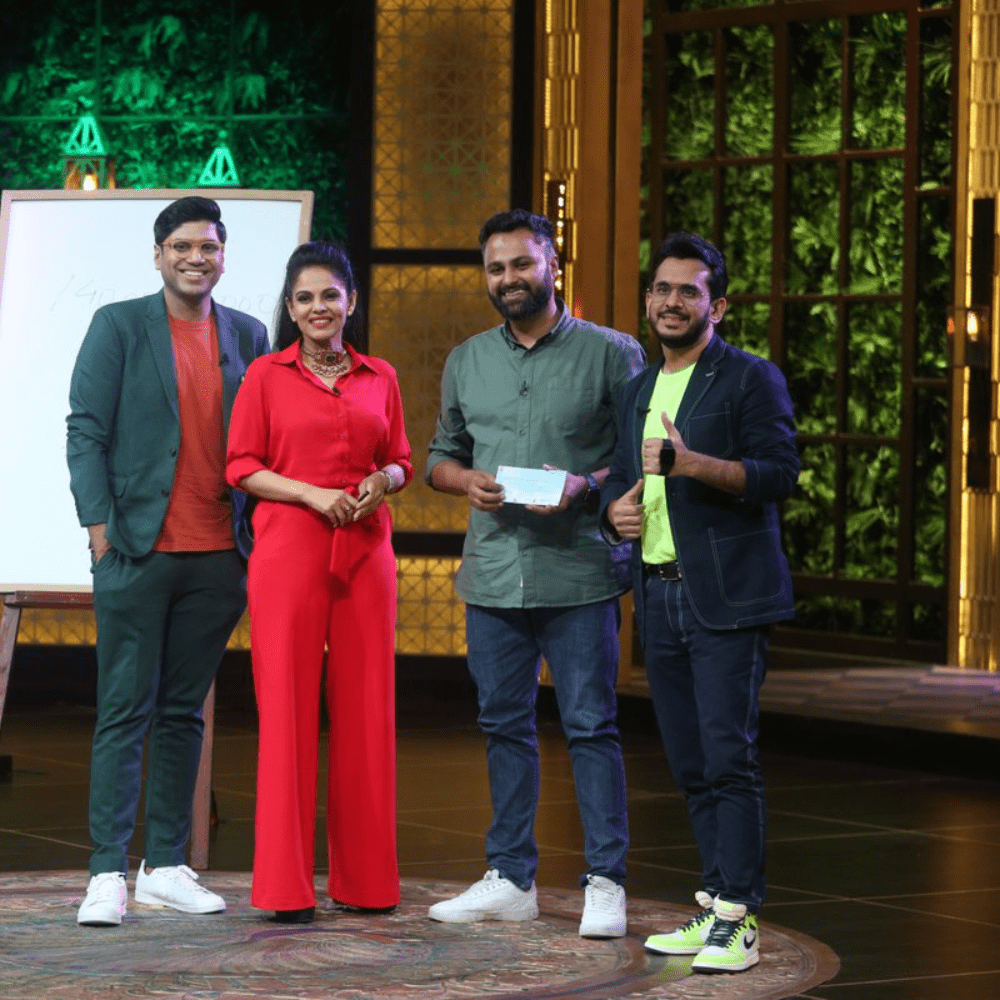

Shark Tank India 2: Anupam Mittal proudly declares, ‘Bharat business seekh raha hai,’ after a rare all-shark deal

The last episode of Shark Tank India 2 featured a rare all-shark deal, with Anupam Mittal describing the occasion as significant to India’s entrepreneurial ecosystem. Every episode of Shark Tank

The government has asked Vodafone Idea to convert interest payments into equity worth Rs 16,133 crore at Rs 10 per share

‘We wanted a strong promise that the Aditya Birla Group will run the company and bring in the necessary investments,’ says Telecom Minister Ashwini Vaishnaw. The government agreed on Friday

The government proposes adjustments to the income tax rules for startups: A key official discusses how it will help the sector grow

According to tax experts, the Budget proposes modifying Section 56 of the Income Tax Act to combat tax evasion. A top government official said on Friday that proposed revisions to

The Hindenburg Effect: 10 Adani Group equities have lost Rs 8.8 lakh crore in market capitalization from their 52-week highs

Adani Group equities are down up to 60% from their 52-week highs, wiping away more than $100 billion from their total market capitalization. The listed firms of Gautam Adani’s Adani

The Sensex and Nifty50 are trading higher ahead of the Union Budget 2023, with Adani Enterprises, Britannia, and Reliance Industries among the companies to watch

On Wednesday, the Sensex and Nifty50 were trading higher ahead of the Union Budget 2023 and the US Fed meeting. The SGX Nifty, a leading indicator of how the markets

Budget 2023 Reactions: According to Hiranandani MD, the budget should prioritize infrastructure spending

Union Finance Minister Nirmala Sitharaman will submit the Modi government’s final full-fledged Union Budget 2023 before the 2024 Lok Sabha elections. Union Budget 2023: Union Finance Minister Nirmala Sitharaman will

Jugeshinder Singh, CFO of Adani Group, claims that Hindenburg merely copied and pasted our disclosures without conducting any additional study

The CFO of the conglomerate claimed that the “bogus study based on lies and misrepresentation” could not discover any way to falsify the group’s enterprises. This was in response to

Are you thinking about getting an MBA? Here’s why Lenskart CEO Peyush Bansal thinks it’s not worth it

Bansal further stated that while a business school can assist with networking and understanding the business ecosystem through case studies, entrepreneurship provides hands-on experience. Peyush Bansal, CEO of Lenskart and

BYJU’s Founder and CEO has announced that the company will not extend its partnerships with the BCCI, ICC, and FIFA

The company made headlines in September 2022 when it disclosed its financial statements after nearly an 18-month delay, with losses increasing to Rs 4,588 crore and sales remaining at Rs

Messi told Divya Gokulnath, a co-founder of BYJU’S, “My dream was to be a footballer; I spent all day with a ball”

A conversation between Lionel Messi and Divya Gokulnath, co-founder of BYJU’S, was taking place. In November of last year, Messi signed on to serve as the company’s brand ambassador. In

This business is utilizing abandoned gas pipelines from the 1800s to help with telecom traffic via network as a service

CloudExtel was created in 2014, but its tale began much earlier, during the Gilded Age in British-ruled Bombay and even before electricity was invented. Bombay Gas used to send gas

On Shark Tank India 2, Namita Thapar defends turning down funding for a competitor start-up by saying, “Being a shark doesn’t imply”

The executive director of Emcure Pharmaceuticals said on Shark Tank India that she criticizes toxic behavior and refuses to join the uneducated crowd that applauds dishonest people. Shark Tank India

According to CEO Deepinder Goyal, Zomato received more orders on New Year’s Eve than it did in the previous three years combined

Deepinder Goyal, co-founder, and CEO of Zomato, revealed that the firm delivered roughly 15 tonnes of biryani that evening. For businesses that deliver food and conduct rapid commerce, December 31

The CEO of Zoho describes how India is able to develop businesses like Apple, Google, and Pfizer

In a Twitter conversation, Zoho CEO Sirdhar Vembu outlined how India can create globally competitive businesses like Apple, Google, Pfizer, Samsung, Honda, Boeing, Siemens, TSMC, or Huawei. He asked, “Why

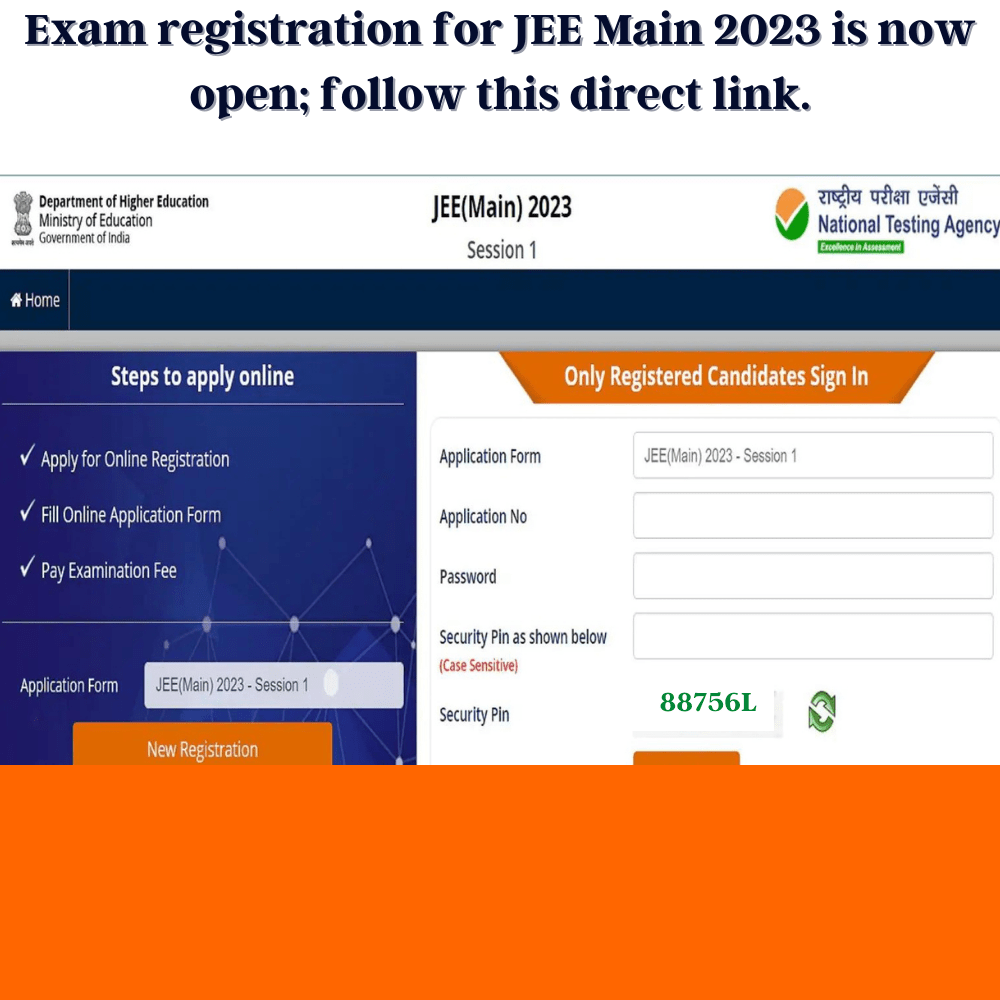

For JEE Advanced 2023 registration, fees, and exam dates, see the table below

Description: Candidates who are interested and qualified should visit the jeeadv.ac.in official website. The Joint Entrance Examination Advanced JEE Advanced 2023 official announcement has been posted by the Indian Institute

How Adobe’s Indian-origin CEO scripted its success during the 2009 financial crisis, growing its market valuation from $6 billion to $200 billion.

Shantanu Narayen, CEO of Adobe, offered a few personal anecdotes. He claimed that if he had been beginning his career now, he would never have left Hyderabad. One of the

Indian-origin After Markus Dohle resigns, Nihar Malaviya is designated Penguin Random House’s interim CEO.

The parent company of the New York-based multinational publishing group, Bertelsmann, announced on Friday that Nihar Malaviya will start serving as Interim CEO on January 1, 2023. Indian descent Penguin

Sushmita Shukla designated First Vice President & Chief Operating Officer of the Federal Reserve Bank of New York

First Vice President and Chief Operating Officer at the Federal Reserve Bank of New York, Sushmita Shukla, an insurance sector veteran of Indian descent, is now the second-ranking official at

SuperPlatform is made available to game developers thanks to a partnership between SuperGaming and Google Cloud.

With Google Cloud’s safe, scalable, and sustainable infrastructure, SuperPlatform may be accessed at scale by more game creators. SuperPlatform is a SaaS (software as a service) and will be an

Paytm is ‘on the right track to profitability,’ according to CEO Sharma, as loan disbursements increased 387% in October.

Paytm’s loan disbursement value increased 387% year on year to 3,056 crore, while the number of loans disbursed increased 161%. In a letter to shareholders, Paytm CEO Vijay Shekhar Sharma

RIL to restructure and upscale its financial services business as Jio Financial Services Ltd

RSIL(to be renamed Jio Financial Services Ltd.) is currently a wholly-owned subsidiary of RIL and is a Reserve Bank of India-registered non-deposit-taking systemically important (ND-SI) non-banking financial company. The board

Round 1 allotment results for NEET UG Counseling 2022 will be released today. Here’s how to check them and other information

Those applicants who are offered a place are required to report to the college between October 22 and October 28. Today, October 21, the Medical Counselling Committee (MCC) will release

Anuradha Ramachandran has been appointed as managing partner at TVS Capital

TVS Capital invests in technology-driven financial services and enterprise (B2B) services. Unicorns such as Digit Insurance, Five Star Business Finance, and Yubi are currently in their Fund-3 portfolio (CredAvenue). Anuradha

Losing Messi and Ronaldo did not have a negative effect on La Liga viewership, according to the league’s India MD Jose Cachaza

Although Lionel Messi and Cristiano Ronaldo left their respective La Liga clubs, the league’s president of India claims that viewership has climbed steadily ever since their departures. Even when Cristiano

Instagram is down globally, and users are complaining and posting jokes on Twitter

Twitterati reported that the social networking site “Instagram” was unavailable to thousands of users worldwide. Twitterati reported that the social networking site “Instagram” was unavailable to thousands of users worldwide.

Swiggy and Zomato are among the top 10 international online food delivery companies mentioned in the report

Swiggy and Zomato were ranked ninth and tenth, respectively, by the international research company ETC Group, which has its headquarters in Canada. According to recent research, domestic online meal delivery

Zetwerk, a unicorn company in manufacturing services, reports a six-fold increase in FY22 revenues to Rs 4,961 crore

When non-cash expenses for the employee stock ownership plan (ESOP) are taken into account, the company’s overall losses remain essentially identical at Rs 42 crore. In its FY22 audited results

Cetcell.mahacet.org will start offering MHT CET counseling in 2022; direct link, schedule

Candidates may submit an application for MHT CET counseling in 2022 via cetcell.mahacet.org or fe2022.mahacet.org. State Common Entrance Test Cell Maharashtra has begun the counseling procedure for MHT CET 2022

Investment banker Naresh Kothari’s Alpha Alternatives raises ₹130 crores

Founded in 2013, Alpha Alternatives is a multi-asset class alternate asset management platform which has multiple strategies across absolute return, credit, commodities, value and quant-driven equities, and fixed income. Investment

To combat online extremism, YouTube and Meta will develop policies and conduct research

Critics have criticized platforms like Alphabet’s YouTube and Meta Platforms’ Facebook for years, claiming that the corporations have permitted hate speech, misinformation, and violent language to flourish on their services.

Here are instructions on how to check the MHT CET Result 2022: PCM, PCB scorecard that is being released today

For admission to undergraduate programs in engineering and technology, agriculture, and pharmacy, MHT CET tests are held in 2022. Students can verify their results on the board’s official websites, such

Alphabet Inc. is in active discussion on plans to set up a manufacturing facility in India for Pixel phones.

Apple Inc, the company’s main smartphone rival, already makes at least four models up to iPhone 13 in India through contract manufacturing partners Foxconn and Wistron. It is reportedly considering

DCGI grants Bharat Biotech permission to use the intranasal Covid-19 vaccine for emergency use.

Mandaviya posted on Twitter, saying, “India’s Battle Against COVID-19 Gets a Huge Boost! The @CDSCO INDIA INF has approved Bharat Biotech’s ChAd36-SARS-CoV-S COVID-19 (Chimpanzee Adenovirus Vectored) recombinant nasal vaccine for

A new mobile application may successfully identify Covid-19: The researchers claim that the AI model is accurate 89% of the time

London: Using artificial intelligence, researchers have created a new smartphone app that may successfully identify COVID-19 infection in people’s voices (AI). According to them, the technique can be employed in

Sputnik V administered intravenously elicits a “durable” immunological response in animals against COVID-19

Scientists assert that the lungs are more susceptible to infection by new coronavirus strains, such as the BA4 and BA5 substrains of Omicron. The effects of the intranasally administered Sputnik

The AP organizes a CEO-Ministerial dialogue in order to attract $4 billion in investment in the EV sector

Andhra Pradesh is hosting the first-ever CEO-Ministerial Dialogue under the World Economic Forum-Moving India Network in order to attract $4 billion in investment in the EV segment. On Friday, Andhra

The emphasis is on payments and the distribution of lending products: Vijay Shekhar Sharma, the founder of Paytm

According to Vijay Shekhar Sharma, the company is still on track to achieve operating profitability by September 2023. One97 Communications Ltd, which operates under the Paytm brand, will sharpen its

Vineeta Singh of Shark Tank claims that “95 percent” of the comments on her posts are about her appearance

Vineeta Singh, the most polite shark on Shark Tank, has discussed how she frequently receives trolling and criticism in the social media comment sections for her appearance or clothing choices.

Hashed Emergent and other investors contribute $3 million to the Crypso cryptocurrency trading platform

The additional funding will be used by Crypso to expand its user base, product offerings, and technological capabilities. Crypso, a platform for community-driven cryptocurrency trading, has received $3 million (roughly

Aakash Educational Services, owned by Byju, expects to grow by 60-70 percent this year, with new centers and hiring on the horizon

According to a top official, test preparation major Aakash Educational Services (AESL), which is owned by Byju’s, is confident of growing by 60-70 percent this year, with market demand, hirings,

RBSE 12th Result 2022: Rajasthan BSER Science and Commerce results will be released today at 2 p.m.

BSER Science, Commerce Results 2022: The results of the Class 12 final examinations in Science and Commerce will be available on June 1 at rajeduboard.rajasthan.gov.in. RBSE 12th Science, Commerce Result

After users reported access issues, Instagram owner Meta is working to restore the platform

More than 6,600 Instagram users have reported problems. After thousands of users reported problems accessing the image-sharing network, Meta Platforms announced on Thursday that it was trying to restore Instagram.

On May 13, Prime Minister Narendra Modi will unveil the Madhya Pradesh government’s startup policy

On May 13, Prime Minister Narendra Modi will virtually launch Madhya Pradesh’s Startup Policy and Implementation Plan-2022. BHOPAL: Prime Minister Narendra Modi will virtually launch the Madhya Pradesh government’s Startup

Arjun Mohan of upGrad: Post-appraisal season is a great time for us to start talking to our customers

Arjun Mohan, CEO of upGrad, discusses timing the edtech brand’s campaigns to coincide with evaluation time, moving to the next phase with vertical-based marketing, and more. After spending the previous

Bank of Maharashtra Generalist Officer Result 2022 has been declared, and a direct link can be found here.

The Bank of Maharashtra Generalist Officer Result 2022 is now available. Candidates can access the results via the Bank of Maharashtra’s official website or the direct link provided below. Bank

Bhavish Aggarwal performs a dance to ‘Bijlee-Bijlee’ to test a new Ola E-Scooter feature called MoveOS 2.0.

Bhavish Aggarwal tweeted, “Doing some final “expert testing” for the MoveOS 2 music feature,” tagging Slokarth Dash and attaching a video of the duo dancing. Ahead of the much-anticipated launch

Anupam Mittal does not appear pleased with YouTuber Mythpat’s impersonation of him; fans say he should “now collaborate with Ashneer Grover.”

Anupam Mittal’s reaction, who appears from behind and inquires as to what is going on, demonstrates the accuracy of Mythpat’s impersonation. He then proceeded to strangle Mythpat jokingly. You can

Flipkart invests $116 million in Myntra in the face of competition from Reliance’s Ajio and Nykaa

Singapore: According to Singapore regulatory filings, Flipkart has invested $116 million in fashion retailer Myntra, according to Economic Times. According to the report, the investment was made on March 25,

Ashneer Grover’s investment in this Kerala-based banana chip manufacturer yielded a threefold profit

Following a series of controversies surrounding his removal from BharatPe, Ashneer Grover recently met with Kerala-based businessman Manas and posted a picture of their meeting on social media. Manas’ banana

Varun Dhawan, a Bollywood actor, invests in Curefoods and becomes the face of the company’s flagship brand EatFit

Curefoods, a cloud kitchen company that houses brands like as EatFit, Frozen Bottle, CakeZone, and Great Indian Khichdi, has obtained money from Bollywood star Varun Dhawan and established a long-term

Falguni Nayar, the founder of Nykaa, is among the top ten self-made female billionaires in the world, according to new research.

According to the survey, the number of self-made women billionaires in India has tripled in the last decade. Falguni Nayar, the founder of Nykaa, entered the top ten list of

YouTube Rolls Out New Health Features in India to Highlight, Identify Videos From Verified Sources

YouTube’s wellbeing source data boards will mark recordings from certified wellbeing associations and government elements. YouTube is bringing two new wellbeing-centered highlights to guarantee the validity of wellbeing data on

Paytm clarifies its stock’s all-time low, claiming that the company’s fundamentals remain strong

According to One97 Communications, the business has complied with SEBI requirements and provided all required disclosures to stock exchanges. One97 Communications, the parent company of Paytm, explained in a late-night

Deepinder Goyal, the creator of Zomato, has announced that the company would begin offering 10-minute food deliveries.

MUMBAI: As rapid services catch up to food aggregator platforms, Ant Group-backed Zomato Ltd intends to deliver food in 10-minutes, according to the company’s founder Deepinder Goyal. “After becoming a

Telegram’s ban has been lifted by the Brazilian Supreme Court after the platform complied with a court order to delete some accounts

Pavel Durov, the founder of Telegram, apologized for the company’s “negligence” in responding to court demands. According to a statement on the court’s website, an order barring the use of

According to reports, a sponsorship agreement between Spotify and Barcelona will net the football club EUR 300 million

From July, Barcelona’s home stadium will be known as Spotify Camp Nou. Barcelona announced on Tuesday that Spotify will be their primary sponsor beginning next season, with the club’s stadium

Google Messages now has iMessage reactions, live transcriptions, portrait blur, and other features similar to iMessage

Support for iMessage reactions, powerful photo editing tools that will allow users to blur pictures within the chat, a grammar correction tool, live transcription, and other features have been added

WhatsApp has released a browser extension to ensure that you are using the authenticated web version of the app

WhatsApp’s Code Verify extension is available for download on Chrome, Firefox, and Edge. WhatsApp released a Web browser extension called Code Verify on Friday, which allows users to check whether

Navi Technologies, founded by Sachin Bansal, is planning an IPO of Rs 4,000 crore and would file a DRHP soon.

The investment banks overseeing the share sale include ICICI Securities, BofA, and Axis Capital. An initial public offering (IPO) is being planned by Navi Technologies to earn Rs 4,000 crore

Shareholders of BharatPe may have to settle the Grover-Koladiya feud, with the board unlikely to intervene

Bengaluru: The ongoing feud between two cofounders of BharatPe, Bhavik Koladiya and Ashneer Grover, over Koladiya’s stake in the company, is an issue that BharatPe’s shareholders will have to resolve,

Ashneer Grover loses an arbitration case against a governance review, according to BharatPe.

Grover filed an arbitration petition with the Singapore International Arbitration Centre, alleging that the company’s inquiry of him was unlawful. According to sources, BharatPe co-founder and managing director Ashneer Grover

Shares of Zomato, Paytm, and Nykaa will be included in the Nifty Next 50 index. Details can be found here.

The NSE Indices Index Maintenance Sub-Committee – Equity has voted to alter the eligibility criterion for NIFTY equity indices. From March 31, 2022, newly listed equities Zomato, One97 Communications (Paytm),

Madhuri Jain has been fired by BharatPe, and Grover’s role may be reduced to that of a stakeholder.

BT discovered that the employee contract undersigned also included a provision for the company to reclaim the dismissed employee’s equity. One individual familiar with the situation revealed to BusinessToday that

Paytm and Nykaa stock prices have fallen to fresh 52-week lows as a result of the market correction; ICICI Securities recommends buying Paytm stock

Paytm’s stock has lost more than 60% of its value since its peak, while Nykaa’s stock has lost 42% of its value since its peak. Paytm’s shares slid 2.2 percent

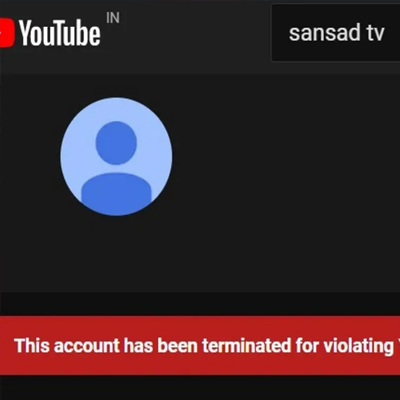

Sansad TV’s YouTube account has been restored, according to the channel, which claims it was hacked due to unauthorized activities by’scamsters.’

The name of the Sansad TV YouTube channel was erroneously changed to Ethereum. Sansad TV, which broadcasts live coverage of the Lok Sabha and Rajya Sabha, said its YouTube channel

Rahul Bajaj, the founder of the Bajaj Group, has died at the age of 83; Nitin Gadkari, Milind Deora, and other leaders have paid rich tributes.

In 2001, Rahul Bajaj received India’s third-highest civilian award, the Padma Bhushan. Rahul Bajaj, chairman emeritus of the Bajaj Group, died on Saturday in Mumbai. He was 83 years old

Apple Music’s free trial period has been reduced from three to one month in several countries, according to a report.

The change has no bearing on the restricted 6-month trial period offered with the purchase of certain Apple devices for a limited time. In various countries, including the United States,

IND versus WI: During the 1st ODI against West Indies, Indian players wear black bands in honour of Lata Mangeshkar.

In their first One-Day International against the West Indies, members of the Indian men’s cricket squad are wearing the black armband to commemorate the death of great vocalist Lata Mangeshkar.

A Chinese man claims to have created the world’s largest power bank, with a capacity of 27,000,000mAh and the ability to charge over 5,000 phones.

Description: According to the developer, the power bank can power a TV, a washing machine, and even charge electric scooters. Handy Geng, a Chinese electronics expert and influencer, has developed

UPSC Recruitment 2022: Bumper openings have been announced on upsc.gov.in, and you can verify your eligibility here.

Description: Interested and eligible applicants can apply online at upsc.gov.in, the UPSC’s official website. The announcement for the civil service exam (CSE) 2022 has been released by the Union Public

The SpaceX rocket successfully launched a spy satellite for the United States.

According to the National Reconnaissance Office (NRO), the satellite will aid in overhead reconnaissance activities. The NRO conceived, built, and operates NROL-87 to serve its overhead reconnaissance mission, according to

WhatsApp’s ‘Delete for Everyone’ feature could be extended to more than two days; Community Information Surfaces

According to reports, WhatsApp for Android beta version 2.22.410 had references to an update for the ‘Delete for Everyone functionality. WhatsApp is apparently planning on expanding the ‘Delete for Everyone

Live Budget 2022 Updates: According to Modi, the ‘people-friendly, progressive’ budget will help young people achieve their goals.

India Live, Budget 2022 Live updates on Nirmala Sitharaman’s speech: Finance Minister Nirmala Sitharaman stated at a press conference after delivering the Union Budget that she made a conscious decision

According to Nirmala Sitharaman, the Union Budget 2022-23 aims to establish the groundwork for India’s progress over the next 25 years.

The finance minister stated that the government’s focus will be on increasing public investment in infrastructure modernization. New Delhi: Finance Minister Nirmala Sitharaman said in the Lok Sabha on Tuesday

Budget 2022 Live Updates on Cryptocurrency Taxes: According to FM, revenue from virtual digital assets is subject to a 30% tax.

Updates on Crypto Taxation in Budget 2022, Cryptocurrency Taxation in the Union Budget of 2022: Live Updates: Crypto taxation is likely to be clarified in the upcoming budget. Live Updates

On an empty aircraft, a SpiceJet air attendant dances to the popular Bengali song Kacha Badam. Watch this video that has gone viral

Uma Meenakshi, a SpiceJet air hostess, tried out the widespread Kacha Badam Instagram craze. She posted a video of herself on an empty airplane dancing to the song. Over 23,000

UPSC Engineering Services Exam dates for 2022 have been announced: click here to see the UPSC ESE schedule

UPSC Engineering Services Exam 2022: Check out the UPSC ESE Prelims examination schedule here. UPSC Engineering Services Exam 2022: The UPSC Engineering Services Exam (ESE) 2022 test schedule has been

Albert Bourla, the CEO of Pfizer, has been awarded the Genesis Prize, a $1 million prize for developing the COVID-19 vaccine.

Each year, a $1 million prize is given to a person for their professional accomplishments, humanitarian efforts, and adherence to Jewish ideals. Bourla received the most votes in an online

Abhimanyu Saxena, co-founder of Scaler, on the importance of taking time off to promote diversity and inclusion in the workplace.

According to Sclaer’s co-founder, a workspace may transform into a platform where all employees feel appreciated and heard if additional start-ups and larger organisations implement comparable efforts. Scaler Academy, an

China’s GDP was expected to rise at an annual rate of 8.1 percent in 2021, but development challenges remain.

In the last three months of 2021, growth in the world’s second-largest economy slowed to 4% from a year earlier, according to government figures released Monday. China’s economy was expected

WhatsApp for Android will get new drawing tools, and the desktop app will get a new color scheme, according to a new report.

WhatsApp is also rumored to be working on an Android app with a blur image feature. WhatsApp’s Android and desktop apps are apparently getting additional functionality. The instant chat software

Fact Checkers claim that YouTube allows its platform to be ‘weaponized’ to spread misinformation.

According to fact-checking organizations, YouTube’s efforts to remedy the issue are insufficient. More than 80 fact-checking organizations have urged YouTube to address widespread disinformation on the platform. The organizations claim

Twitter’s seven-month ban in Nigeria has been lifted, and the company plans to open an office in the country

On June 4, Nigeria halted Twitter’s operations. The Nigerian government has reversed the country’s Twitter ban, seven months after the country’s more than 200 million people were barred from using

Spider-Man: Into the Spider-Verse Home Box Office Up to $1.54 billion, it is now the eighth-highest-grossing film of all time.

Even though the ever-increasing threat of the fast-spreading Omicron strain has pushed practically all-new theatrical releases, Spider-Man: No Way Home continues to rocket up the box office charts. With a

‘Fake audio by a con artist,’ says BharatPe CEO Ashneer Grover of a viral clip showing him cursing a banker.

Notably, an unsubstantiated audiotape of Grover purportedly insulting a Kotak Mahindra Bank staffer over the non-allocation of shares in Nykaa went viral on Tuesday night. Ashneer Grover, CEO of BharatPe,

OSSC SI recruitment: The list of candidates who have been shortlisted for the PET has been released.

OSSC SI recruitment: The Odisha Staff Selection Commission (OSSC) on Tuesday announced a list of candidates who have been provisionally shortlisted for the positions of Sub-Inspector of Police, Handwriting Bureau,

Warren Buffett’s top stocks: Apple, Bank of America, and others have risen by more than 50% this year; which ones do you own?

Berkshire Hathaway, Warren Buffett’s company, has the most stock in four companies: Apple, Bank of America Corporation, American Express Company, and The Coca-Cola Company. Warren Buffet is the CEO of

Ratan Tata celebrates his 84th birthday: Did you know Tata shares his birthday with another business magnate and a former finance minister?

Ratan Tata’s birthday is today. Did you know that Ratan Tata shares his birthday with several other notable Indians as he turns 84? How can so many fascinating people be

Google files a complaint with the Karnataka High Court in response to the CCI’s investigation into Play Store guidelines.

Google has filed a writ case in the Karnataka High Court, requesting extra time to respond to the Competition Commission of India’s inquiries into its Play store guidelines. The firm

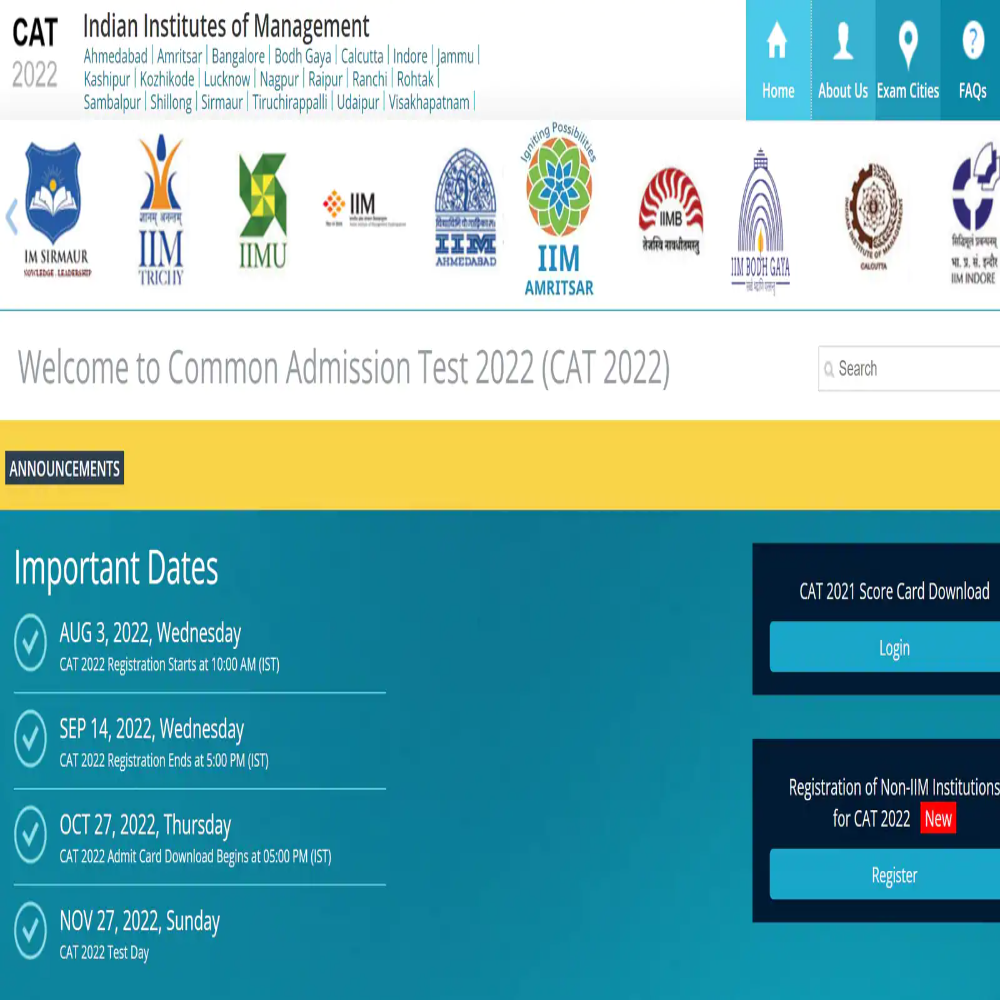

The IIM CAT 2021 Result is expected in the second week of January 2022. Here’s how to determine your percentile score for the IIM CAT 2021 exam.

IIM CAT 2021 result: Here’s how to calculate percentile score IIM CAT Result 2021: In January 2022, the Indian Institute of Management, IIM (Ahmedabad), will announce the results of the

Zee Entertainment’s merger with Sony Pictures Networks, and contours of the deal

The two firms have signed a non-binding term sheet to integrate their respective linear networks, digital assets, production divisions, and program libraries. Zee Entertainment Enterprises Ltd (ZEELBoard )’s of Directors

Prepaid package from Airtel for Rs 99 Check out the cheapest prepaid plan with bundled SMS perks.

Airtel’s Rs 99 prepaid plan, which is also the cheapest prepaid plan with bundled SMS advantages, is now apparently offering SMS perks. Last month, telecom companies announced prepaid pricing increases.

Apple wants the antitrust case against India’s app market dismissed because of its “tiny market share.

The complaint was filed after the Competition Commission of India (CCI) began investigating claims that Apple is harming competition by forcing app developers to use its proprietary system, which can

Nio, a Chinese automaker, has unveiled the ET5, its second electric sedan, to compete with Tesla’s Model 3.

Nio Inc., a Chinese electric vehicle manufacturer, has unveiled its second sedan, which will directly compete with Tesla Inc.’s most popular Model 3. Nio Inc., a Chinese electric vehicle manufacturer,

Microsoft has launched a cybersecurity training program in India that would train over 1 lakh people.

Microsoft has released four new security, compliance, and identity certificates, with the approved Fundamentals certification available for free to anyone who completes the associated training through this project. Microsoft announced

Join the Indian Army in 2021: Details on the 40 Technical Graduate Course can be found here.

Candidates for the Technical Graduate Course will be recruited by the Indian Army. Candidates can apply online at joinindianarmy.nic.in, the Indian Army’s official website. Candidates for the Technical Graduate Course

The Lok Sabha has passed a measure that will elevate the status of six pharmacy education institutions.

On Monday, the Lok Sabha passed a bill designating six institutes of pharmaceutical education and research as institutes of national importance and establishing a council to oversee the development of

UPPSC Prelims Results in 2021: Candidates are dissatisfied since the commission ignores their own criteria.

For the PCS-2021 exam, which was held on October 24, a total of 6,91,173 candidates applied online. The results of the Combined State/Upper Subordinate Services (Preliminary) Examination-2021, also known as

School uniforms: Gender-diverse students’ struggles and trauma

While observing gender-specific dress standards in school, transgender adolescents typically suffer internal challenges. High dropout rates, psychological distress, and skewed career pathways among transmen and transwomen are caused in part

After the UPTET was cancelled due to a paper leak, Yogi stated that the National Security Agency (NSA) would be used to prosecute the perpetrators.

After a question paper for the exam was leaked, the UPTET slated for Sunday was canceled, an officer here announced moments before the exam was to begin. After a question

Examine how liberation fighters are depicted in school textbooks, including a section on the Vedas: Panel for the House

“While a review process is always required, this should be done including acknowledged experts from all around the country…” the Indian History Congress remarked, strongly criticizing the committee’s proposals. A

MPSC is hiring scientific officers and scientific assistants in Manipur; learn more.

The Manipur Public Service Commission (MPSC) is accepting applications for scientific officers and scientific assistants through December 20. The Manipur Public Service Commission (MPSC) has issued a call for applications